The term “starter home” has a new meaning. The average price of a home in Boulder jumped from $166,000 in 2000 to $966,000 in 2025. Boulder’s cost of living is 41% higher than the national average. This means a dozen eggs that costs $4 in Jackson, Mississippi, will cost $5.64 in Boulder, Colorado. What does that mean for housing?

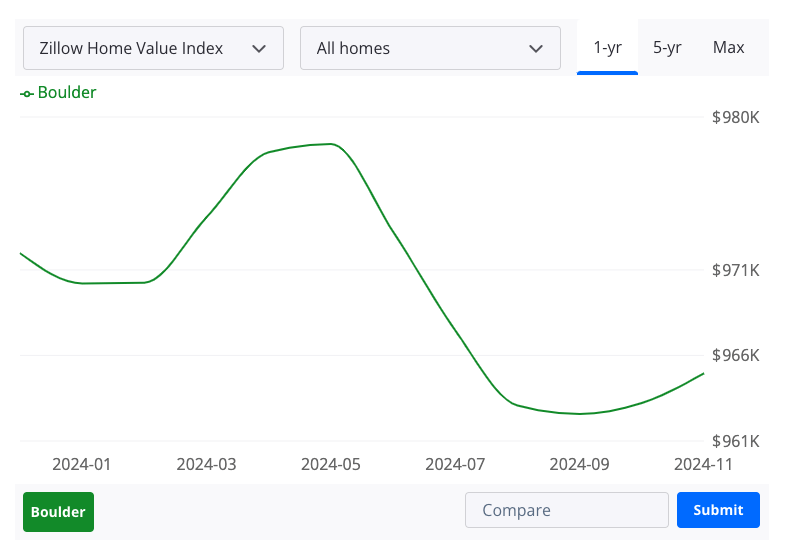

The median sale price of homes in Boulder County, Colo. in 2024 was $970,000, according to Zillow.com. To match a house payment with the average rental price of $2,300 per month, a buyer needs $725,000 for a down payment.

With a median household income of $84,840 and expenses of $77,280 yearly, an excess of $7,560 per year will require ninety-five years to save the downpayment.

Zillow.com Boulder Housing Market Overview 2023 – 2024 – accessed Jan. 3, 2025

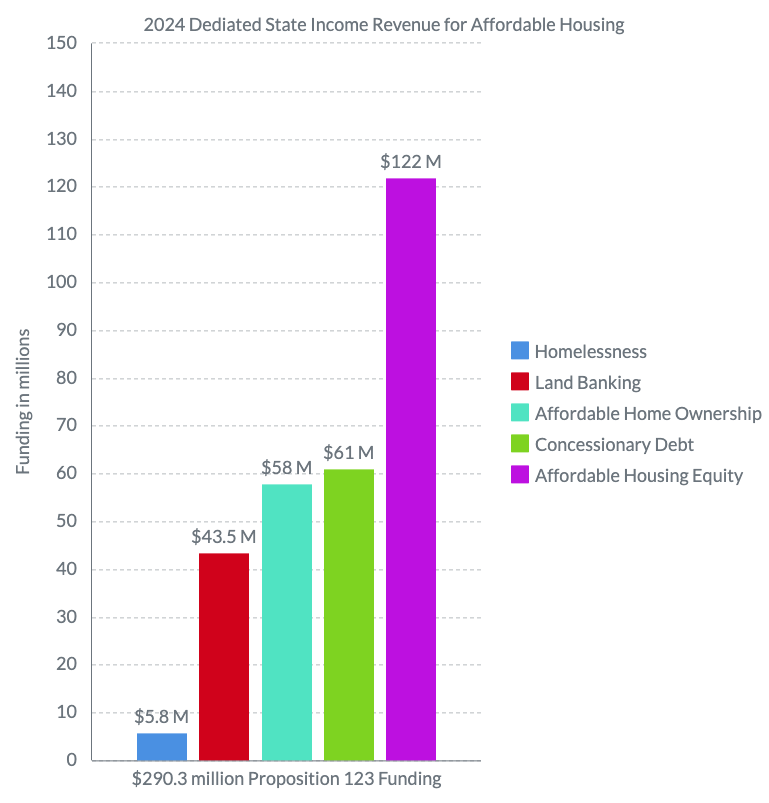

The Common Sense Institute of Colorado reported in January of 2023 that voters passed Proposition 123 with a 54 percent majority to fund affordable housing programs statewide.

Data USA. Adobe Express. (Melodie Miller / Creator)

Data USA reported similar data for Boulder, Colorado, in 2022, with a higher median household income of $99,700 and a lower median property value of $671,100. This additional $14,860 yearly income means a buyer could buy a house in 25 years.

However, according to Pro Builder, housing prices in Boulder increased 121% or $107 per day between 2015 and 2025. If prices continue to rise at that rate, a future buyer’s goal becomes non viable.

State Senator Dylan Roberts – Colorado Senate Democrats (Photographer / Uncredited)

“During my time in the state senate, I have been trying to find ways to lower the cost of living,” Senator Dylan Roberts said, “and this starts first and foremost with housing.”

Common Sense Institute Colorado Jan. 30, 2023

Proposition 123 dedicated a total of $290 million toward housing equity in the first year. Willoughby Corner at 120th and Emma Street in Lafayette is part of the Boulder County Housing Authority (BCHA) 400 affordable housing project using some Proposition 123 funding.

https://www.pinkardbuilds.com/expertise/affordable-housing-construction

“It takes a lot of funding. It takes federal funding, state funding, and a lot of it is funded by the low-income housing tax credits,” Bill Cole, housing partnership and policy manager for Boulder County. “It’s a federal program run through the state.”

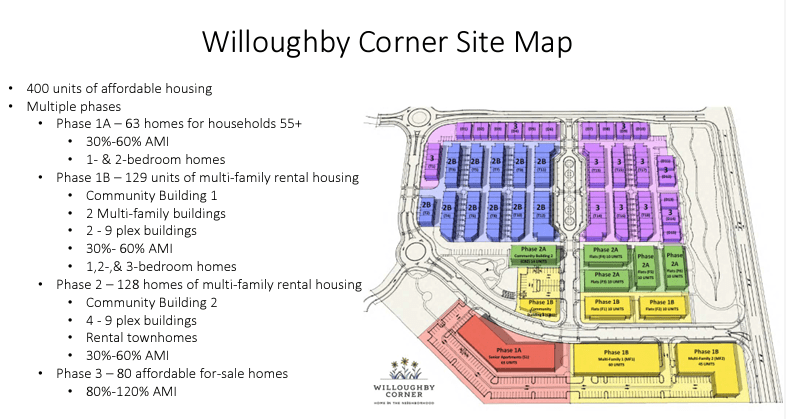

According to Cole, the Willoughby Corner construction takes three phases. The first phase is 90 units of senior housing. The second phase is multifamily apartments totaling 200 units. “The third phase is actually going to be homeownership opportunities, townhomes, about 80 units,” Cole said. All units except the senior housing have a waiting list.

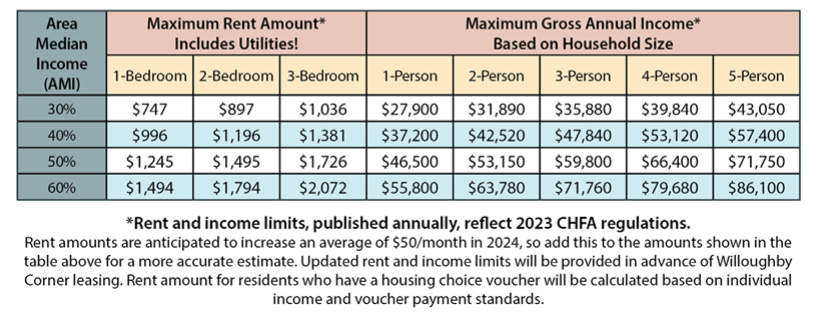

willoughby-corner-open-house-presentation-7-26-23 PDF (assets.bouldercounty.gov)

Boulder County’s affordable housing imposes income limits that exclude many people from government benefits. The average Boulder County resident earning a salary of $84,840 will not qualify for this benefit.

Boulder County Rent and Income Limits – Willoughby Center

Some potential home buyers find that there is no solution for home ownership. These buyers earn more than the income base to qualify for affordable housing but do not earn enough to make a substantial down payment.

“With 6% interest rate right now, how does a new home buyer afford that?” Boulder County realtor Ernie Sica said. “They have to have a really substantial income. That is really hard.”

With a mandatory high down payment, future homeowner Elena Sedin said, “My parents are already paying for my college. They can’t help me buy a house.”

According to Cole, those individuals who qualify for affordable housing should “Look at Prop 123. There’s gonna be a lot of the state funding for the foreseeable future,” Cole said. “Boulder County plans to build multifamily, senior and single-family developments as it tries to “increase the housing in the city of Boulder.”

Leave a comment